SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

the Securities Exchange Act of 1934 (Amendment No. )

![[MISSING IMAGE: cov_ofc-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/cov_ofc-4c.jpg)

![[MISSING IMAGE: lg_ironwood-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/lg_ironwood-bw.jpg)

20212024 ANNUAL MEETING OF STOCKHOLDERS OF

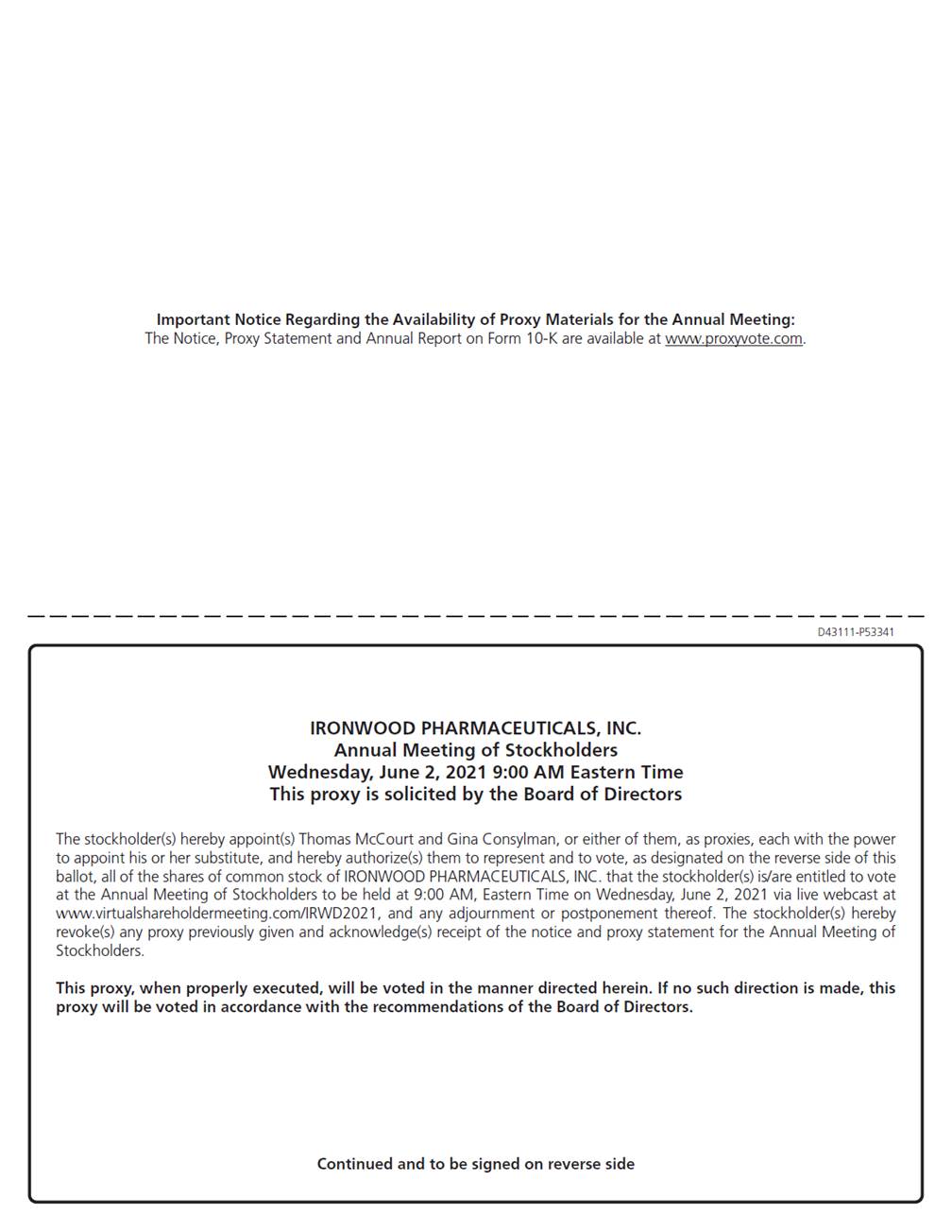

IRONWOOD PHARMACEUTICALS, INC. Date: Tuesday, June 18, 2024 Date:Time: Wednesday, June 2, 2021Time: 9:00 a.m. Eastern Time Location:Location: 20212024 annual meeting of stockholders will be a "virtual“virtual meeting."” You will be able to attend the annual meeting, vote and submit questions via live webcast by visiting www.virtualshareholdermeeting.com/IRWD2021IRWD2024. Purpose:Purpose: We are holding the annual meeting for stockholders to consider three company sponsored proposals: 1. Class I directors,nine director nominees, Mark G. Currie, Ph.D., Alexander J. Denner, Ph.D. and, Andrew Dreyfus, Jon R. Duane, and our Class II directors, Marla L. Kessler, Thomas McCourt, Julie McHugh, Catherine Moukheibir Lawrence S. Olanoff, M.D., Ph.D. and Jay P. Shepard, each to serve for a one-year term;term extending until our 2025 annual meeting of stockholders and their successors are duly elected and qualified; committee'scommittee’s selection of Ernst & Young LLP as our auditors for 2021.2024. "for"“for” each of the nine nominees for Class I and Class II director (proposal no. 1), "for"“for” the advisory vote on named executive officer compensation (proposal no. 2), and "for"“for” ratification of our selection of auditors (proposal no. 3). Only stockholders of record at the close of business on April 12, 202119, 2024 are entitled to notice of and to vote at the meeting.The safety of our stockholders is important to us and given the current guidance by public health officials and protocols that federal, state and local health authorities have imposed surrounding the coronavirus (COVID-19) pandemic, at the time of this filing we believe it is not advisable to hold ourperson.prior years, will be conducted in a virtual-only format, solely by means of a live audio webcast. Our virtual stockholder format uses technology designed to provide our stockholders rights and opportunities to participate in the virtual meeting similar to an in-person meeting. A virtual meeting allows more stockholders to attend the meeting without cost from anywhere around the globe. You may attend the meeting, vote and submit questions electronically during the meeting via live webcast by visiting the website provided above. A list of stockholders of record will be available electronically during the meeting. The website can be accessed on a computer, tablet, or phone with internet connection. To be admitted to the meeting at www.virtualshareholdermeeting.com/IRWD2021IRWD2024, you must enter the 16-digit control number found on your proxy card, voting instruction form or notice that you received.![[MISSING IMAGE: sg_thomasmccourt-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/sg_thomasmccourt-bw.jpg)

Chief Executive Officer and Director

![[MISSING IMAGE: htr_bluegreen-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_bluegreen-4c.jpg)

![[MISSING IMAGE: ph_ironwood-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/ph_ironwood-4c.jpg)

| | ||||||||

| Letter From Our | ||||||||

| | | | | 1 | | | ||

| ||||||||

| | | | | 3 | | | ||

| ||||||||

| | | | | 8 | | | ||

| | | | | 28 | | | ||

| | Our Executives | | | | | 30 | | |

| | Executive Compensation | | | | | 33 | | |

| | ||||||||

| | | | | 33 | | | ||

| | ||||||||

| | | | | 54 | | | ||

| | CEO Pay Ratio | | | | | 64 | | |

| | Pay Versus Performance | | | | | 65 | | |

| | ||||||||

| | | | | 72 | | | ||

| | Our Stockholders | |||||||

| | | | | 74 | | | ||

| | Certain Relationships and Related Person Transactions | |||||||

| | | | | 77 | | | ||

| | ||||||||

| | | | | 78 | | | ||

| | User’s Guide | | | | | 80 | | |

| | Stockholder Communications, Proposals and Nominations for Directorships | |||||||

| | | | | 84 | | | ||

| | SEC Filings | |||||||

| | | | | 85 | | |

2021 Proxy Statement i

![[MISSING IMAGE: htr_greenorange-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorange-4c.jpg)

![[MISSING IMAGE: ph_thomasmccourtbg-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/ph_thomasmccourtbg-4c.jpg)

Our team showed passion and commitment in 2020 as we continued

We have a significant opportunity to execute on our vision to become the leading U.S. gastrointestinal, or GI, healthcare company, advancing treatments for GI diseases and redefining the standard of care for GI patients. Our strategy to get there is grounded on three priorities: maximizing LINZESS, building an innovative GI pipeline, and delivering sustained profits and generating cash flow.

We are Executing Our GI-Focused Strategy

LINZESS showed remarkable resilience in 2020, delivering $931 million in 2020 U.S. net sales—an increase of 10% year-over-year—further strengthening its position as the number one prescribed medicine in the U.S. for the treatment of adults with irritable bowel syndrome with constipation, or IBS-C, or chronic idiopathic constipation, or CIC. We believe there is substantial opportunity for continued growth and are working closely with our partner, AbbVie Inc., or AbbVie, to advance innovative commercial strategies and enhance linaclotide's clinical utility through lifecycle management.

We are also seeking to build an innovative development portfolio by advancing our own IW-3300 for the potential treatment of visceral pain conditions and by pursuing assets that target serious, organic GI diseases. We had some disappointing outcomes from our GI development pipeline last year, and while these types of outcomes are not uncommon in drug development, they are never easy when there are so many patients in need of new therapies. However, with continued scientific progress and our unique expertise and capabilities within GI, we remain committed in our pursuit of innovative treatments for GI diseases.

And lastly, we are continuing our disciplined approach to capital allocation to support our goal of delivering sustainable profits and cash flow. We achieved our second full year of profits in 2020, recording $106 million in net income. Importantly, we ended 2020 with $363 million in cash and cash equivalents—more than doubling our cash position from the end of 2019.

We are Committed to Fostering an Inclusive and Diverse Culture

We believe that creating an equitable, inclusive and diverse culture is critical to attracting, motivating, and retaining the talent necessary to deliver on our mission. In 2020, we adopted a long-term equality, diversity and inclusion strategy, introduced new learning and development opportunities, strengthened our talent acquisition strategies, and made contributions to organizations that advance racial equality and social justice in our communities.

2021 Proxy Statement 1

We are Focused on Driving Stockholder Value

We remain focused on driving value for our stockholders by bringing important medicines to patients and building a growing and successful business. This is central to successfully executing against our strategic priorities and a critical threshold as we continue to invest thoughtfully into our business. Thank you for supporting Ironwood and our path forward. I am confident that with continued focus and execution, Ironwood is well positioned to deliver benefits for patients and value for stockholders.

Sincerely,

![]()

Thomas McCourtPresident and Interim Chief Executive Officer

2 Ironwood

We aspire to bring innovative treatments for GI diseases to patients in need.

We are a GI healthcare company on a mission to advance the treatment of GI diseases and redefine the standard of care for GI patients. LeveragingThis guiding mission drives us to deliver game-changing GI treatments to patients in need and to do good in the communities in which we and our demonstrated expertisestakeholders live and capabilitieswork.

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

![[MISSING IMAGE: sg_thomasmccourt-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/sg_thomasmccourt-bw.jpg)

![[MISSING IMAGE: htr_greenorange-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorange-4c.jpg)

LINZESS®need, leveraging our demonstrated expertise and capabilities in GI diseases.

patients.

Our

- sustained profits and cash flow.

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

2021 Proxy Statement 3

2.Advance U.S. GI Development Portfolio•MD-7246:We and AbbVie announced top-line data from a Phase II trial evaluating MD-7246, a delayed release formulation of linaclotide,other regulatory filings for apraglutide for use in adult patients withabdominal pain associated with irritable bowel syndrome with diarrhea, or IBS-D. TheSBS who are dependent on PS.

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

•We delivered net income of $106 million during the year ended December 31, 2020, reflecting our second consecutive full year of profitability.•

We demonstrated strong progress acrossrealize our corporate goalsvision of becoming the leading GI healthcare company in 2020. As a result, our 2020the industry.

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

4 Ironwood

![[MISSING IMAGE: htr_bluegreen-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_bluegreen-4c.jpg)

|

![[MISSING IMAGE: bc_line-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/bc_line-4c.jpg)

| | Name | | | Age | | | Audit Committee | | | Governance and Nominating Committee | | | Compensation and HR Committee | | ||||||||||||

| | Mark Currie, Ph.D. | | | | | 69 | | | | | | | | | | | | | | | | | | ✓ | | |

| | Alexander Denner, Ph.D. | | | | | 54 | | | | | | | | | | | | C | | | | | | | | |

| | Andrew Dreyfus | | | | | 65 | | | | | | | | | | | | | | | | | | C | | |

| | Jon Duane | | | | | 65 | | | | | | | | | | | | ✓ | | | | | | ✓ | | |

| | Marla Kessler | | | | | 54 | | | | | | | | | | | | | | | | | | ✓ | | |

| | Thomas McCourt | | | | | 66 | | | | | | | | | | | | | | | | | | | | |

| | Julie McHugh, Chair | | | | | 59 | | | | | | ✓ | | | | | | ✓ | | | | | | | | |

| | Catherine Moukheibir | | | | | 64 | | | | | | C | | | | | | | | | | | | | | |

| | Jay Shepard | | | | | 66 | | | | | | ✓ | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Name | Age | Class | Year Term Expires | Audit Committee | Governance and Nominating Committee | Compensation and HR Committee | ||||||

| | | | | | | | | | | | | |

Mark G. Currie, Ph.D. | 66 | I | 2021 | | | | ||||||

Alexander J. Denner, Ph.D. | 51 | I | 2021 | ✓ | ||||||||

Jon R. Duane | 62 | I | 2021 | | ✓ | ✓ | ||||||

Marla L. Kessler | 51 | II | 2021 | ✓ | ||||||||

Catherine Moukheibir | 61 | II | 2021 | C | | | ||||||

Lawrence S. Olanoff, M.D., Ph.D. | 69 | II | 2021 | C | ||||||||

Jay P. Shepard | 63 | II | 2021 | ✓ | | | ||||||

Andrew Dreyfus | 62 | III | 2022 | C | ||||||||

Julie H. McHugh, Chair | 56 | III | 2022 | ✓ | ✓ | | ||||||

Edward P. Owens | 74 | III | 2022 | ✓ | ||||||||

| | | | | | | | | | | | | |

"C"“C” indicates chair of the committee.

2021 Proxy Statement 5

Class I Directors (nominated for election at the 2021 annual meeting)

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

| | | | | |

MARK CURRIE, Ph.D.

Partner, Iaso Ventures, LP Age: 69 Director since 2019 Board Committees • Compensation and HR Committee | | | • Dr. Currie has • Prior to joining Ironwood, Dr. Currie directed cardiovascular and central nervous system disease research as vice president of discovery research at Sepracor, Inc. and initiated, built and led discovery pharmacology and also served as director of arthritis and inflammation at Monsanto Company. • Dr. Currie currently serves on the board of directors of Antag Therapeutics ApS, Science Exchange, Inc. and Sea Pharmaceuticals, LLC, each of which is a privately held company. Dr. Currie also chairs the scientific advisory boards of Wild Bioscience Ltd. and Tisento Therapeutics, Inc. • Dr. Currie earned a B.S. in biology from the University of South Alabama and holds a Ph.D. in cell biology from the Bowman Gray School of Medicine of Wake Forest University. • We believe that Dr. | |

| | | | | |

ALEXANDER DENNER, Ph.D. Founding Partner and Chief Investment Officer, Sarissa Capital Management LP Age: 54 Director since 2020 Board Committees • Governance and Nominating Committee, Chair | | | • Dr. Denner is a founding partner and the chief investment officer of Sarissa Capital Management LP, or Sarissa, a registered investment advisor, where he has been since 2011. • Prior to joining Sarissa, Dr. Denner served as a senior managing director at Icahn Capital • Dr. Denner serves on the board of directors of • Dr. Denner earned his B.S. in mechanical engineering from Massachusetts Institute of Technology, an M.S. and • Dr. Denner brings to the board significant experience overseeing the operations and research and development of healthcare companies and evaluating corporate governance matters. He also has extensive experience as an investor, particularly with respect to healthcare companies, and possesses broad healthcare industry knowledge. | |

6 Ironwood

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

| | | | | |

ANDREW DREYFUS Former President and Chief Executive Officer for Blue Cross Blue Shield of Massachusetts Age: 65 Director since 2016 Board Committees • Compensation and HR Committee, Chair | | | • Mr. Dreyfus most recently served as president and chief executive officer for Blue Cross Blue Shield of Massachusetts, or BCBSMA, one of the largest Blue Cross Blue Shield insurance plans in the country, from 2010 to 2022. From 2005 to 2010, Mr. Dreyfus served as the executive vice president of healthcare services of BCBSMA. • Prior to joining BCBSMA, he served as the first president of the Blue Cross Blue Shield Foundation. Mr. Dreyfus also previously served as executive vice president of the Massachusetts Hospital Association and held a number of senior positions in Massachusetts state government, including undersecretary of consumer affairs and business regulation. • Mr. Dreyfus serves on the board of directors and as a member of the audit committee and the compensation and management development committee of Alto Neuroscience, Inc. (NYSE: ANRO), a public company. Mr. Dreyfus also serves on the board of directors of Octave Health Group Inc., a privately held companyand the Joint Commission, the National Quality Forum and BCBSMA Foundation, all of which are non-profit organizations. He is a member of the advisory boards of Ariadne Labs, Vanna Health and the Massachusetts Coalition for Serious Illness Care. He previously served on the board of directors for BCBSMA, the Blue Cross Blue Shield Association and RIZE Massachusetts. • Mr. Dreyfus received a B.A. in English from Connecticut College. • Mr. Dreyfus brings to our board of directors significant expertise in the healthcare payer and reimbursement market, and broad management and executive leadership experience, providing valuable insight as we continue to develop and commercialize medicines in an evolving healthcare landscape. | |

| | | | | |

JON DUANE Senior Partner Emeritus, McKinsey & Company Age: 65 Director since 2019 Board Committees • Governance and Nominating Committee • Compensation and HR Committee | | | • Mr. Duane is senior partner emeritus at McKinsey & Company, or McKinsey, an international management consulting company. Before his retirement in December 2017, Mr. Duane had served as a partner at McKinsey since 1992. • At McKinsey, Mr. Duane founded and led the • Mr. Duane serves as the executive chair on the board of directors of Nashville Biosciences, LLC, a privately held company. • Mr. Duane graduated from Wesleyan University with a B.A. in government and received an M.B.A from Harvard Business School. • Mr. Duane brings to the board of directors significant experience advising academic research centers and companies across the life science and medical device industries. | |

2021 Proxy Statement 7

Class II Directors (nominated for election at the 2021 annual meeting)

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

| | | | | |

54 | | | • Ms. Kessler most recently served as chief marketing officer of Datavant, Inc., or Datavant, a health IT company, from October 2022 to April 2024. Prior to joining Datavant, Ms. Kessler served as chief customer officer of Aetion, Inc., or Aetion, a health care technology company, from September 2021 to October 2022, and prior that, as an advisor to the chief executive officer of IQVIA Holdings Inc., or IQVIA (formerly IMS Health and Quintiles), a global analytics and technology company, from October 2020 to February 2021. Prior to that, Ms. Kessler had been the senior vice president for strategy, marketing and communications for IQVIA since October 2016. • Previously, Ms. Kessler served in various roles for IQVIA, including vice president for global services marketing and knowledge management from 2013 to • Before joining IQVIA, Ms. Kessler led several marketing efforts for Pfizer Inc. from 2004 to 2007 and worked in consulting for McKinsey & Company from 1996 to 2004. • Ms. Kessler received a B.S. in economics from Arizona State University and an M.B.A. from the Fuqua School of Business at Duke University. • Ms. Kessler provides an important commercial perspective to our board of directors given her expertise in strategic marketing, evidence-based research and customer experience in the life science industry. | |

| | | | | |

THOMAS McCOURT Chief Executive Officer, Ironwood Pharmaceuticals, Inc. Age: 66 Director since 2021 | | | • Mr. McCourt has served as our chief executive officer and member of the board of directors since June 2021 and had previously served as president and interim chief executive officer from March 2021 to June 2021 and as president from April 2019 to June 2021. Prior to April 2019, Mr. McCourt served as our senior vice president of marketing and sales and chief commercial officer since joining Ironwood in 2009. • Prior to joining Ironwood, Mr. McCourt led the U.S. brand team for denosumab at Amgen Inc. from 2008 to 2009. Prior to that, Mr. McCourt was with Novartis AG from 2001 to 2008, where he directed the launch and growth of ZELNORM™ for the treatment of patients with IBS-C and CIC and held a number of senior commercial roles, including vice president of strategic marketing and operations. • Mr. McCourt was also part of the founding team at Astra-Merck Inc., leading the development of the medical affairs and science liaison group and then serving as brand manager for PRILOSEC® and NEXIUM®. • Mr. McCourt serves on the board of directors and as a member of the compensation committee of Pliant Therapeutics, Inc. (Nasdaq: PLRX), a public company, and on the board of trustees for the American Society of Gastrointestinal Endoscopy (ASGE). Mr. McCourt previously served on the board of directors of Acceleron Pharma Inc., including as a member of the audit committee and the chair of the nominating and governance committee. • Mr. McCourt received a B.S. in pharmacy from the University of Wisconsin. • Given his role as our chief executive officer and his previous leadership roles at the company since joining in 2009, we believe Mr. McCourt brings unique and in-depth insight into the operations and management of the company, which together with his extensive commercial experience, his deep knowledge of GI, and his experience launching and achieving blockbuster status for LINZESS, are valuable to our board of directors. | |

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

| | | | | |

JULIE McHUGH, CHAIR Former Chief Operating Officer, Endo Health Solutions, Inc. Age: 59 Director since 2014 Board Committees • Audit Committee • Governance and Nominating Committee | | | • Ms. McHugh most recently served as chief operating officer for Endo Health Solutions, Inc., or Endo, from 2010 through 2013, where she was responsible for the specialty pharmaceutical and generic drug businesses. • Prior to joining Endo, Ms. McHugh was the chief executive officer of Nora Therapeutics, Inc. • Before that she served as company group chair for the worldwide virology business unit of Johnson & Johnson, or J&J, and previously she was president of Centocor, Inc., a J&J subsidiary. While at J&J, Ms. McHugh oversaw the development and launches of several products, including Remicade® (infliximab) and she was responsible for oversight of a research and development portfolio including compounds targeting autoimmune diseases, HIV, hepatitis C, and tuberculosis. • Prior to joining Centocor, Inc., Ms. McHugh led marketing communications for gastrointestinal drug Prilosec® (omeprazole) at Astra-Merck Inc. • Ms. McHugh currently serves on the board of directors of Lantheus Holdings, Inc. (Nasdaq: LNTH), a public company, and Xellia Pharmaceuticals ApS, a privately held company. She also serves on the strategic advisory board for HealthCare Royalty Partners and the board of visitors for the Smeal College of Business of Pennsylvania State University. She previously served on the board of directors for Aerie Pharmaceuticals, Inc., Trevena, Inc., ViroPharma Inc., Epirus Biopharmaceuticals, Inc., Evelo Biosciences, Inc., the Biotechnology Industry Organization, the Pennsylvania Biotechnology Association and the New England Healthcare Institute. • Ms. McHugh received her M.B.A. degree from St. Joseph’s University and her B.S. degree from Pennsylvania State University. • Ms. McHugh’s experience as a chief executive officer and a chief operating officer at large multinational pharmaceutical companies makes her a valuable member of our board of directors. Her deep knowledge of Ironwood’s history and strategy and strong relationships with our senior leadership team also make her a valuable resource. | |

| | | | | |

CATHERINE MOUKHEIBIR Former Chief Executive Officer, MedDay Pharmaceuticals Age: 64 Director since 2019 Board Committees • Audit Committee, Chair | | | • Ms. Moukheibir most recently served as chief executive officer of MedDay Pharmaceuticals, or MedDay, a biopharmaceutical company that focused on nervous system disorders, from July 2019 to January 2021. She was also the • Prior to that, Ms. Moukheibir served as the senior advisor for finance and a member of the executive board of directors at Innate Pharma SA, an oncology company, from 2011 to • Ms. Moukheibir previously served as the director of capital markets for Zeltia Group S.A. from 2001 to 2007. • Ms. Moukheibir currently serves on the board of directors of the following public companies: MoonLake Immunotherapeutics AG (Nasdaq: MLTX), Biotalys NV (EBR: BTLS) and • Ms. Moukheibir has an M.A. in economics and an M.B.A. from Yale University. • Ms. | |

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

| | | |

|

|

| | | |||

JAY SHEPARD Former President and Chief Executive Officer of Aravive, Inc. Age: 66 Director since 2020 Board Committees • Audit Committee | | | • Mr. Shepard is an advisor at Catalyst Pacific, a venture group focused on licensing drug programs and creating new companies in the U.S. and Japan. Mr. Shepard previously was president and chief executive officer of Aravive, Inc. (formerly Versartis, Inc.), a clinical-stage oncology company, from May 2015 to January 2020, Versartis, Inc. • From • Mr. Shepard has over 35 years of experience in the pharmaceutical, biotechnology and

drug delivery arenas. Mr. Shepard has participated in or led over 16 product launches by preparing markets and establishing sales and marketing operations. • Mr. Shepard also currently serves on the board of directors of the following public companies: Inovio Pharmaceuticals, Inc. • Mr. Shepard holds a B.S. in Business Administration from the University of Arizona. • Mr. Shepard brings deep expertise to our board of directors, as a recognized leader within the pharmaceutical industry, with nearly three decades of expertise as an accomplished public company CEO and senior executive. | |

We believe that our board of directors should be comprised of individuals with sophistication and experience in many substantive areas that will help us achieve our vision of becoming a leading other diversity criteria. Annual Evaluations finding suitable candidates. of our board of directors.20219

Class III Directors (term expires at the 2022 annual meeting)![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

ANDREWDREYFUSPresident and Chief ExecutiveOfficer for Blue Cross BlueShield of MassachusettsAge: 62Director since 2016Board Committees •Compensation and HR Committee, Chair•Mr. Dreyfus has served as president and chief executive officer for Blue Cross Blue Shield of Massachusetts, or BCBSMA, one of the largest Blue Cross Blue Shield insurance plans in the country, since 2010. From 2005 to 2010, Mr. Dreyfus served as the executive vice president of healthcare services of BCBSMA. •Prior to joining BCBSMA, he served as the first president of the Blue Cross Blue Shield Foundation. Mr. Dreyfus also previously served as executive vice president of the Massachusetts Hospital Association and held a number of senior positions in Massachusetts state government, including undersecretary of consumer affairs and business regulation. •Mr. Dreyfus serves on the board of directors of BCBSMA, the Blue Cross Blue Shield Association, Boys & Girls Clubs of Boston and RIZE Massachusetts. He is a member of the advisory boards of Ariadne Labs and the Leonard D. Schaeffer Center for Health Policy & Economics at the University of Southern California (USC). He is a founding member of the Massachusetts Coalition for Serious Illness Care. •Mr. Dreyfus received a B.A. in English from Connecticut College. •Mr. Dreyfus brings to our board of directors significant expertise in the healthcare payer and reimbursement market, and broad management and executive leadership experience, providing valuable insight as we continue to develop and commercialize medicines in an evolving healthcare landscape. JULIE H.McHUGH, CHAIRFormer Chief Operating Officer,Endo Health Solutions, Inc.Age: 56Director since 2014Board Committees •Audit Committee •Governance and Nominating Committee•Ms. McHugh most recently served as chief operating officer for Endo Health Solutions, Inc., or Endo, from 2010 through 2013, where she was responsible for the specialty pharmaceutical and generic drug businesses. •Prior to joining Endo, Ms. McHugh was the chief executive officer of Nora Therapeutics, Inc. •Before that she served as company group chairman for the worldwide virology business unit of Johnson & Johnson, or J&J, and previously she was president of Centocor, Inc., a J&J subsidiary. While at J&J, Ms. McHugh oversaw the development and launches of several products, including Remicade® (infliximab), Prezista® (darunavir) and Intelence® (etravirine), and she was responsible for oversight of a research and development portfolio including compounds targeting HIV, hepatitis C, and tuberculosis. •Prior to joining Centocor, Inc., Ms. McHugh led the marketing communications for gastrointestinal drug Prilosec® (omeprazole) at Astra-Merck Inc. •Ms. McHugh currently serves on the board of directors of Trevena, Inc. (with such service to end in connection with Trevena, Inc.'s 2021 annual meeting of stockholders), Aerie Pharmaceuticals, Inc. and Lantheus Holdings, Inc. She also serves on the board of directors of Evelo Biosciences, Inc., including serving as chair of the nominating and corporate governance committee and as a member of the audit committee. She also chairs the board of visitors for the Smeal College of Business of Pennsylvania State University as well as serves on the board of directors of The New Xellia Group. She previously served on the board of directors for ViroPharma Inc., Epirus Biopharmaceuticals, Inc., the Biotechnology Industry Organization, the Pennsylvania Biotechnology Association and the New England Healthcare Institute. •Ms. McHugh received her M.B.A. degree from St. Joseph's University and her B.S. degree from Pennsylvania State University. •Ms. McHugh's experience as a chief executive officer and a chief operating officer at large multinational pharmaceutical companies makes her a valuable member of our board of directors. Her deep knowledge of Ironwood's history and strategy and strong relationships with our senior leadership team also make her a valuable resource, particularly during the chief executive officer transition period.10 Ironwood

EDWARD P.OWENSFormer Partner, Portfolio Managerand Global Industry Analyst,Wellington ManagementCompany, LLPAge: 74Director since 2013Board Committees •Audit Committee•Mr. Owens was previously partner, portfolio manager and global industry analyst with Wellington Management Company, LLP where he worked in investment management from 1974 to 2012. He was the portfolio manager of the Vanguard Health Care Fund for 28 years from its inception in May 1984 until his retirement from Wellington in December 2012. •Mr. Owens serves on the board of directors of Stealth BioTherapeutics Corp and ESCAPE Bio. He has a B.S. in physics from the University of Virginia and an M.B.A. from Harvard Business School. •He brings to our board of directors extensive experience in evaluating and investing in life sciences companies, providing valuable insight as we continue to strive towards our goal of maximizing long-term stockholder value.2021 Proxy Statement 11

How We are Selected and Evaluated U.S. GI healthcare company dedicated to advancing the treatment of GI diseases and redefining the standard of care for GI patients.owner-orientedowner oriented attitude and a commitment to represent the interests of our stockholders, demonstrated, in part, through ownership of our stock; (b) strong personal and professional ethics, integrity and values; (c) strong business acumen and savvy; (d) a deep, genuine passion for our business and the patients whom we serve; (e) demonstrated achievement in the nominee'snominee’s field of expertise; (f) the absence of conflicts of interest that would impair the nominee'snominee’s ability to represent the interests of our stockholders; (g) the ability to dedicate the time necessary to regularly participate in meetings of the board and committees of our board; and (h) the potential to contribute to the diversity of our board of directors, as a result of the nominee'snominee’s professional background, expertise, gender, age, ethnicity or ethnicity.directorsboard of director nominees possess the professional and personal qualifications and necessary expertise both within and outside of the healthcare industry to maintain a diverse and experienced board of directors that can effectively represent stockholders.![[MISSING IMAGE: bc_line-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/bc_line-4c.jpg)

Ironwood Board of

Directors Broader Business Healthcare Industry

Allocation /

Finance /

Accounting Strategic

Transactions Risk

Management Human

Capital Public

Company

Board Senior

Leadership

(small

biotech) Senior

Leadership

(large

pharma)

Market Insights

(patient, payer,

physician) Broader BusinessHealthcare IndustryIronwood Board of DirectorsCapitalAllocation /Finance /AccountingStrategicTransactionsRiskManagementHumanCapitalPublicCompanyBoardSeniorLeadership(smallbiotech)SeniorLeadership(largepharma)Customer /Market Insights(patient, payer,physician) ✓ ✓ Julie H. McHugh✓✓✓✓✓✓✓Andrew Dreyfus✓ ✓✓✓✓Lawrence S. Olanoff, M.D., Ph.D.✓✓✓✓✓✓✓Jon R. Duane✓✓✓✓Edward P. Owens✓✓✓✓Mark G. Currie, Ph.D.✓✓✓✓✓✓✓Marla L. Kessler✓✓✓✓✓Catherine Moukheibir✓✓✓✓✓✓Alexander J. Denner, Ph.D.✓✓✓✓Jay P. Shepard✓✓✓✓✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Andrew Dreyfus ✓ ✓ ✓ ✓ ✓ Jon Duane ✓ ✓ ✓ ✓ Marla Kessler ✓ ✓ ✓ ✓ ✓ Thomas McCourt ✓ ✓ ✓ ✓ ✓ ✓ Julie McHugh ✓ ✓ ✓ ✓ ✓ ✓ ✓ Catherine Moukheibir ✓ ✓ ✓ ✓ ✓ ✓ Jay Shepard ✓ ✓ ✓ ✓ ✓ ![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

![[MISSING IMAGE: bc_line-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/bc_line-4c.jpg)

Board Diversity Matrix (as of April 25, 2024) Board Size: Total Number of Directors 9 Gender Identity: Female Male Non-Binary Did Not Disclose Directors 3 5 1 Demographic Background: African American or Black Alaskan Native or Native American Asian Hispanic or Latinx Native Hawaiian or Pacific Islander White 2 5 Two or More Races or Ethnicities LGBTQ+ Did Not Disclose Demographic Background 1 Directors who self-identify as Middle Eastern 1 20, 2021,25, 2024, the average age of our independent directors'directors was 6162 years, and the average tenure of our independent directors was approximately 3.85.6 years. Six of our ten directors joined our board of directors since our separation, or Separation,12 Ironwood

from Cyclerion Therapeutics, Inc., or Cyclerion, in April 2019, including two directors, Dr. Denner and Mr. Shepard, who joined our board of directors in 2020.member. In addition, each director completes a self-evaluationmember, as well as a peerto provide an opportunity for each director to provide an evaluation of eachthe other director.directors. For 2020, each director, except Dr. Denner and Mr. Shepard,2023, directors completed a written questionnairequestionnaires, which solicited open-endedopen- ended and candid feedback on an anonymous basis. Dr. Denner and Mr. Shepard did not complete a written questionnaire as they joined the board of directors in the fourth quarter of 2020. In addition to the director evaluations, we also solicit annual feedback from senior management concerning the board'sboard’s performance on an anonymous basis. After the collective board and committee evaluations and comments (including those from senior management) and the self and peer evaluations andevaluation comments were compiled, the chair of the governance and nominating committee met with our chair of the board and Mark Mallon, our former chief executive officer, to discuss the board and committee evaluations and individual evaluations for directors. The chair of the governance and nominating committee also conducted individual feedback sessions with each director (except Dr. Denner and Mr. Shepard) to discuss the results of his or her individual evaluation and then provided the governance and nominating committee with a summary of the individual evaluations for the Class I and Class II directors up for election at the 2021 annual meeting of stockholders. The chair of the governance and nominating committee then presented a summary of the collective![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

The boardWe and management had built a strong relationship with Dr. Denner from his role as chief investment officer of Sarissa Capital Management LP, one of Ironwood's largest stockholders, and valued his significant experience overseeing the operations of healthcare companies. For that reason, our governance and nominating committee recommended and the board elected Alexander J. Denner, Ph.D. to join our board effectiveof directors retain executive search firms and other third parties from time to time to assist in November 2020. In 2020, we also worked with a leadership consulting firm to identify opportunities to build on capabilities we believed were necessary to execute on our strategic priorities. In connection with that process, we identified an opportunity to add a director with experience as a chief executive officer in the pharmaceutical industry with a history of value creation through inorganic growth to our board. We then retained a search firm to identify candidates that met these qualifications and, through that process, identified Jay P. Shepard, who the governance and nominating committee recommended and the board elected to join our board effective in December 2020.Directorships—Directorships — Communications. Stockholder-recommendedStockholder recommended candidates whose recommendations comply with these procedures will be evaluated by the governance and nominating committee in the same manner as candidates identified by the governance and nominating committee.2021 Proxy Statement 13

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

![[MISSING IMAGE: bc_line-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/bc_line-4c.jpg)

How We are OrganizedNumber of Independent Directors/Total Number of Directors 8/9 All Board Committees Comprised Solely of Independent Directors ✓ Separate Independent Chair and Governed Chief Executive Officer Positions ✓ Regular Executive Sessions of Independent Directors ✓ Annual Board and Committee Assessments ✓ Annual Election of All Directors ✓ Annual Advisory Stockholder Vote on Executive Compensation ✓ Stock Ownership Guidelines for Directors and Executive Officers ✓ Comprehensive Code of Business Conduct and Ethics ✓ Corporate Governance Guidelines ✓ Prohibition of Hedging and Pledging by Executive Officers and Directors ✓ Anti-Overboarding Policy Limiting the Number of Other Public Company Boards on which our Directors May Serve ✓ Clawback Policy ✓ tennine members. Any additional directorships resulting from an increase in the number of directors will be apportioned by our board of directors among the three classes until the declassificationboard of directors as described further below.In accordance with the terms of our Certificate of Incorporation, our board of directors is currently divided into three classes, which has resulted in staggered elections. Upon the expiration of the one-year term of a class of directors, directors in that class will be eligible to be nominated andare elected for a new one-year term at the annual meeting in the year in which their term expires. The current members of each class are set forth in the table above under Who We Are.On the recommendation of our board of directors, our stockholders voted at our 2019 annual meeting of stockholders to amend our Certificate of Incorporation to declassify our board of directors to allow the company's stockholders to vote on the election of the entire board of directors on an annual basis rather than on a staggered basis. Consistent with the amendment to our Certificate of Incorporation that was approved by our stockholders, the declassification of the board of directors is being phased in as follows:•at our 2020 annual meeting of stockholders, the Class I directors stood for election for a one-year term; •at our 2021 annual meeting of stockholders, the Class I and Class II directors will stand for election for a one-year term; and •at our 2022 annual meeting of stockholders, and at each annual meeting of stockholders thereafter, all directors will stand for election for one-year terms.For so long as our board of directors is classified, directors maycan be removed by our stockholders only for cause. Following the declassification of our board of directors, our directors will be removable with or without cause by our stockholders.directors'directors’ oversight of, and independence from, management, and enables the board of directors to carry out its responsibilities on behalf of our stockholders. This leadership structure also allows our chief executive officer to focus his or her time and energy on operating and managing the company, while leveraging the experience and perspective of Ms. McHugh, the current chair of our board of directors. We expect the nextThe governance and nominating committee has determined that Ms. McHugh should continue to serve as chair rotation will take place in 2024.company'scompany’s board of directors must be comprised of independent directors. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company'scompany’s audit, compensation and governance and nominating committees be independent, and that audit and compensation committee members satisfy the additional independence criteria set forth in Rule 10A-3 and 10C-1, respectively, under

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

14 Ironwood

company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

R&D until April 2019.

2021 Proxy Statement 15

As set forth in its charter, our audit committee discusses with management any significant risks or exposures facing Ironwood, evaluates the steps management has taken or proposes to take to mitigate such risks and reviews our compliance with such mitigation plans. As part of fulfilling these responsibilities, the audit committee meets regularly with Ernst & Young LLP, our independent registered public accounting firm, and members of our management, including our chief executive officer and chief financial officer. Additionally, our audit committee oversees our cybersecurity risk and receives regular reports, with a minimum frequency of once per year, from our Chief Information Officer on various cybersecurity matters, including risk assessments, mitigation strategies, areas of emerging risks, incidents and industry trends and other areas of importance. Our audit committee also discusses with Ernst & Young LLP any significant risks or exposures facing the company to the extent that such risks or exposures relate to accounting and financial reporting and reviews related mitigation plans with Ernst & Young LLP. In addition, our audit committee reviews the risk factors as presented in our annual reports on Form 10-K and our quarterly reports on Form 10-Q, as applicable, that we file with the SEC.

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

Equality, Among other things, our corporate governance guidelines limit the number of other public company boards on which our directors may serve. Accordingly, our directors should not serve on more than four public company boards of directors, including Ironwood. In addition, our directors who hold the position of chief executive officer of a public company should not serve on more than three public company boards of directors, including Ironwood and the board of his or her own company. Our governance and nominating committee conducts an annual review of director commitment levels, and affirms that as of March 31, 2024, all directors were in compliance with our corporate governance guidelines.

We believe that creating an (DE&I)

In 2020, we established an EDI working group dedicatedhave a simple vision in mind: to advancing key EDI initiatives. Ironwood's leadership team and board of directors champions these efforts. In October 2020, our management adopted a long-term EDI strategy and, in January 2021, our board of directors approved a specific corporate goal for 2021 aimed at

16make Ironwood

fostering an environment where employees feel includedrooted in valuing each employee for who they are.

policies. As of December 31, 2020,2023, women represented approximately 50% of our employees are women, and women represent approximately 30%employee base, 20% of our leadership team (vice president and above) and nearly 30%33% of our board of directors (including our board and audit committee chairs). Additionally, as of December 31, 2023, approximately 20% of our employees arewere racially or ethnically diverse and in 2020,2023, approximately 40% of our new hires were racially or ethnically diverse.

diverse (excluding Europe-based employees, for which race and ethnicity is not disclosed).

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

2021 Proxy Statement 17

•- discussing our accounting policies and all material correcting adjustments with our management and our independent registered public accounting firm;•discussing with our management any significant risks or exposures facing the company and the related mitigation plans, and discussing with our independent registered public accounting firm any significant risks or

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

Our board of directors has determined that Ms. Moukheibir is an audit committee financial expert, as defined in Item 407(d)(5) of Regulation S-K.

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

Ironwood'sIronwood’s financial reporting process, we have (i) reviewed and discussed with management the company'scompany’s audited financial statements for the fiscal year ended December 31, 2020,2023, (ii) discussed with Ernst & Young LLP, the company'scompany’s independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the PCAOB and the SEC, and (iii) received the written disclosures and the letter from Ernst & Young LLP, the company'scompany’s independent registered public accounting firm, required by applicable requirements of the PCAOB regarding the independent registered public accounting firm'sfirm’s communications with us concerning independence, discussed with the independent registered public accounting firm its independence, and considered whether the provision of non-audit services by the independent registered public accounting firm is compatible with maintaining its independence.company'scompany’s Annual Report on Form 10-K for the year ended December 31, 20202023 for filing with the SEC.

Julie McHugh

Jay Shepard

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

2021 Proxy Statement 19

Governance and Nominating Committee

2023.

officers, and oversees matters related to human capital management, including DE&I, workplace environment and culture and talent development and retention.

20 Ironwood

•- reviewing, accessing and making recommendations to our board of directors with respect to director

compensation;- compensation and any stock ownership guidelines applicable to non-employee directors;

•reviewing, approving and overseeing any stock ownership guidelines applicable to executive officers;

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

practices; and

|

Under our second amended and restated 2019 non-employee director compensation policy, effective May 2019,January 1, 2024, or the Director Compensation Policy, the majority of the compensation that our non-employee directors receive for service on our board of directors is paid in the form of restricted shares of our Class A common stock. Vesting of these shares of restricted stock is contingent on each non-employee director continuing to serve as a member of the board of directors on the last day of each applicable vesting period. If a director ceases serving as a member of our board of directors at any time during the vesting period of a restricted stock award, or RSA, unvested shares will be forfeited on the date of such director'sdirector’s termination of service. Shares of restricted stock granted to directors in 2020 under our director compensation policy wereDirector Compensation Policy are granted under our Amended and Restated 2019 Equity Incentive Plan, or our Amended 2019 Plan. Under our Amended 2019 Plan, the aggregate value of all compensation paid or granted to any non-employee director for his or her service as a director in any calendar year may not exceed $600,000.

2021 Proxy Statement 21

award is granted, rounded down to the nearest whole share. Such restricted shares vest in three equal installments on the first three anniversaries of the grant date. In addition, under our director compensation policy,Director Compensation Policy, if a non-employee

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

![[MISSING IMAGE: bc_line-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/bc_line-4c.jpg)

| | | | | Fees | |

| | Annual retainer for members of the board of directors | | | $50,000 ($ | |

| | Additional annual retainer for members of the audit committee | | | $ | |

| | Additional annual retainer for members of the compensation and HR committee | | | $ | |

| | Additional annual retainer for members of the governance and nominating committee | | | $5,000 ($10,000 for the chair) | |

| |

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

![[MISSING IMAGE: bc_line-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/bc_line-4c.jpg)

| | Name | | | Fees Earned or Paid in Cash ($) | | | All Other Stock Awards ($)(1) | | | Compensation ($) | | | Total ($) | | ||||||||||||

| | Mark Currie, Ph.D. | | | | $ | 60,000 | | | | | $ | 240,710 | | | | | | — | | | | | $ | 300,710 | | |

| | Alexander Denner, Ph.D. | | | | $ | 59,976(2) | | | | | $ | 240,710 | | | | | | — | | | | | $ | 300,686 | | |

| | Andrew Dreyfus | | | | $ | 70,000 | | | | | $ | 240,710 | | | | | | — | | | | | $ | 310,710 | | |

| | Jon Duane | | | | $ | 65,000 | | | | | $ | 240,710 | | | | | | — | | | | | $ | 305,710 | | |

| | Marla Kessler | | | | $ | 60,000 | | | | | $ | 240,710 | | | | | | — | | | | | $ | 300,710 | | |

| | Julie McHugh | | | | $ | 95,000 | | | | | $ | 240,710 | | | | | | — | | | | | $ | 335,710 | | |

| | Catherine Moukheibir | | | | $ | 69,978(3) | | | | | $ | 240,710 | | | | | | — | | | | | $ | 310,688 | | |

| | Jay Shepard | | | | $ | 60,000 | | | | | $ | 240,710 | | | | | | — | | | | | $ | 300,710 | | |

| | | | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Total ($) | |||||||

| | | | | | | | | | | |

Mark G. Currie, Ph.D. | $ | 50,000 | $ | 218,286 | $ | 268,286 | ||||

Alexander J. Denner, Ph.D. | $ | 7,912 | (2) | $ | 400,461 | (4) | $ | 408,373 | ||

Andrew Dreyfus | $ | 64,977 | (3) | $ | 218,286 | $ | 283,263 | |||

Jon R. Duane | $ | 62,500 | $ | 218,286 | $ | 280,786 | ||||

Marla L. Kessler | $ | 57,500 | $ | 218,286 | $ | 275,786 | ||||

Julie H. McHugh | $ | 95,000 | $ | 218,286 | $ | 313,286 | ||||

Catherine Moukheibir | $ | 70,000 | $ | 218,286 | $ | 288,286 | ||||

Lawrence S. Olanoff, M.D., Ph.D. | $ | 60,000 | $ | 218,286 | $ | 278,286 | ||||

Edward P. Owens | $ | 60,000 | $ | 218,286 | $ | 278,286 | ||||

Jay P. Shepard | $ | 4,728 | $ | 411,750 | (5) | $ | 416,478 | |||

| | | | | | | | | | | |

(1)- On June

3, 2020,20, 2023, each non-employee member of our board of directorswho was serving on such datereceived a restricted stock grant in the amount of21,72022,350 shares of our Class A common stock for service on our board of directors from the date of our20202023 annual meeting of stockholders to the date of our20212024 annual meeting of stockholders, which shares will vest in full on the date immediately preceding the date of our20212024 annual meeting of stockholders, subject to continued service on our board as of the vesting date. The number of shares subject to the restricted stock grant was determined by dividing (i) $250,000 by (ii) $11.19, which was the average closing price of our Class A common stock on the Nasdaq Global Select Market for the six months preceding the month of the20202023 annual meeting of stockholders. Each such award of restricted stock had a grant date fair value of$10.05$10.77 per share and was granted pursuant to the terms of ourdirector compensation policyprior amended and restated Director Compensation Policy, which was in effect from January 1, 2023 to December 31, 2023, and our 2019 Equity Plan. As of December 31,2020,2023, each non-employee directorother than Dr. Denner and Mr. Shepardheld21,72022,350 restricted shares of Class A common stock as a result of this grant and held no other unvested equity awards.

22 Ironwood

(5)On December 3, 2020, in connection with his election to our board of directors, Mr. Shepard received a restricted stock grant in the amount of 10,830 shares of our Class A common stock, which shares will vest in full on the date immediately preceding the date of our 2021 annual meeting of stockholders, subject to continued service on our board as of the vesting date. The number of shares subject to such restricted stock grant was determined in accordance with the proration formula related to annual equity awards for our directors set forth in our director compensation policy.Additionally, Mr. Shepard received a restricted stock grant related to his initial election to our board in the amount of 24,727 shares of our Class A common stock, which will vest in three equal installments on the first three anniversaries of the date of grant, subject to continued service on our board as of each vesting date. The number of shares subject to this restricted stock grant was determined by dividing (i) $250,000 by (ii) the average closing price of our Class A common stock on the Nasdaq Global Select Market for the six months preceding the month of the date of grant.Each of the two awards of restricted stock had a grant date fair value of $11.58 per share and were granted pursuant to the terms of our director compensation policy and our 2019 Plan. As of December 31, 2020, Mr. Shepard held 35,557 restricted shares of Class A common stock as a result of these grants and held no other unvested equity awards.

Additional Chair Compensation

In connection with Mr. Mallon's resignation as our chief executive officer and a member of our board of directors, Ms. McHugh is spending additional time providing counsel and guidance to the Company's senior leadership team. In connection with her expanded responsibilities and additional time commitment, the compensation and HR committee recommended and the board of directors approved (i) additional cash compensation of $10,000 per month for Ms. McHugh, retroactive to February 15, 2021, for the period in which she serves in this expanded role (as determined by the board of directors), up to a maximum of six months, and (ii) a grant of 2,500 shares of restricted stock, to vest in full in March 2022, subject to Ms. McHugh's continued service on our board of directors through such vesting date. In making its recommendation to the board, the compensation and HR committee took into account a number of factors, including the scope of additional responsibility and anticipated duration and additional time associated with the expanded role, as well as market data provided by our compensation consultant, Rewards Solutions, Aon, which we refer to throughout this proxy statement as 'Aon,' related to board chair compensation.

Director Stock Ownership Guidelines

In May 2019, we

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

2021 Proxy Statement 23

In addition to theMarch 31, 2024, each of our non-employee directors was in compliance with our stock ownership guidelines described above, no director may transfer any shares of restricted stock granted pursuant to our director compensation policy that was effective between January 2014 and May 2019, whether the shares of restricted stock are vested or not, while such person is a director of Ironwood, subject to limited exceptions.

guidelines.

24 Ironwood

![[MISSING IMAGE: cv_ibc-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/cv_ibc-4c.jpg)

of Directors

| ![[MISSING IMAGE: ic_check-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/ic_check-pn.gif) | | | OUR BOARD RECOMMENDS THAT YOU VOTE FOR EACH OF THE DIRECTORS UP FOR ELECTION | |

In furtherance of the phased-in board declassification process described elsewhere in this proxy statement under the caption Board Size and Terms, our![[MISSING IMAGE: ic_prop1-bw.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/ic_prop1-bw.gif)

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

2021

![[MISSING IMAGE: htr_bluegreen-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_bluegreen-4c.jpg)

|

![[MISSING IMAGE: bc_line-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/bc_line-4c.jpg)

| | ||||||||

Name | ||||||||

| | | | | Position(s) | | |||

| Andrew Davis | | 38 | | | Senior Vice President, Chief Business Officer | | |

| | Sravan Emany | | | 46 | | | Senior Vice President, Chief Financial Officer | |

| ||||||||

| John Minardo | | 49 | | | Senior Vice President, Chief | | |

| Michael Shetzline, M.D., Ph.D. | | | 65 | | | Senior Vice President, Chief Medical Officer | |

| | | | | |

38 | | | •

Andrew Davis has served as our chief business officer since December 2021.He previously served as senior vice president • Before joining Ironwood, Mr. Davis served as

|

28 Ironwood

|

Bausch + Lomb. Mr. healthcare space. • Mr. • Mr. Davis holds a | |

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

| | | | | |

46 | | | • Mr. December 2021. • Prior to joining Ironwood, Mr. • Mr. Emany serves on the board of directors of Assertio Holdings, Inc. (Nasdaq: ASRT). • Mr. Emany holds a B.A. in international relations from The Johns Hopkins University and an M.A. in international relations and international economics from The Johns Hopkins School of Advanced International Studies. | |

| | | | | |

JOHN MINARDO Senior Vice President, Chief Legal Officer and Secretary of Ironwood Pharmaceuticals, Inc. Age: 49 Joined Ironwood 2021 | | | • Mr. Minardo has served as our chief legal officer since August 2021. • Prior to joining Ironwood, Mr. Minardo was with Kaye Scholer LLP. • Mr. | |

65 Our executive Named Executive Officers for 2023 culture. 2024. • Exceeded target U.S. LINZESS net sales of $892 million with compliance excellence • Obtained U.S. FDA approval of sNDA to include IBS-C overall abdominal symptoms data LINZESS label • Obtained Phase III data from IW-3718 program and made data-driven "go/no go" decision to discontinue development of IW-3718 • Obtained Phase II data from MD-7246 clinical trial ahead of schedule and made data-driven decision to discontinue development of MD-7246 • In connection with a U.S. disease education and promotional agreement with Alnylam Pharmaceuticals, Inc., Ironwood efforts contributed to >25 patients starting on GIVLAARI® (givosiran) treatment • Built new GI capabilities and expertise • Strengthened and advanced equality, diversity & inclusion (ED&I) initiatives • Exceeded target revenue of $372 million, target adjusted EBITDA* of $105 million, and target cash from operations of $135 million • Delivered 2nd full year of profitability In early Named Executive Officer Compensation Program more detail below. Base salary information for Named Executive Officer Mark Mallon Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. Named Executive Officer Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. 2023 Performance For each of our named executive officers, other than our chief executive officer, 70% of each 2023 cash bonus award 2023 performance. Named Executive Officer Mark Mallon Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. 2023 Long-Term Equity Awards Named Executive Officer Mark Mallon Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. February 28, 2026. Named Executive Officer Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. In making its determinations with respect to the size of the equity awards performance period, which ended on December 31, 2023, was 72%, resulting in a 100% attainment of this performance metric, since the company’s total stockholder return was negative over the three-year performance period. Other than our broad-based benefits, or as otherwise described herein, none of our named executive officers receive perquisites of any nature. order to continue to tie the compensation of our named executive officers to stockholder value creation and hold our executives accountable for our stock price performance. The compensation and HR committee further determined that the three-year performance period for the 2024 PSUs should start on March 1, 2024 and end on February 28, 2027, similar to the approach it took in 2023. This approach will enable both performance metrics to take into account current financial Executive Officer Stock Ownership Guidelines these ownership requirements. Role of the Compensation and HR Committee McCourt. Role of the Compensation Consultant: Benchmarking and Peer Group Analysis rules for the period of their engagement. 2023. 2023. Alpine recommended that five companies from our existing peer group be removed because they either no longer met the revenue screening criterium (Coherus BioSciences, Inc., Organogenesis Holdings Inc. and Vanda Pharmaceuticals, Inc.), or had been, or were in the process of being acquired (Intercept Pharmaceuticals, Inc. and Radius Health Inc.) and identified five potential companies (Ardelyx, Inc., BioCryst Pharmaceuticals, Inc., Insmed, Inc., Mirum Pharmaceuticals, Inc. and Travere Therapeutics, Inc.), to replace the five companies that were recommended to be removed from the prior peer group. This updated peer group is comprised of the following 17 companies, which at the time of approval by our compensation and HR committee had a median 30-day average market capitalization of approximately $1.5 billion, median revenue of approximately $427 million, a median of 250 employees and a commercial drug or drug candidate in later stage development: 2023. Name and Principal Position* Mark Mallon* Former Chief Executive Officer Gina Consylman Chief Financial Officer and Senior Vice President Thomas McCourt* President and Interim Chief Executive Officer Jason Rickard Chief Operating Officer and Senior Vice President Michael Shetzline, M.D., Ph.D. Chief Medical Officer, Senior Vice President and Head of Drug Development Development We granted March 2023. Name Mark Mallon Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. on the achievement of The Cyclerion equity awards were granted to Mr. McCourt in connection with the Separation. None of our other named executive officers hold any Cyclerion equity awards. Name Mark Mallon Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. Gina Consylman Thomas McCourt Jason Rickard Option Exercises and Stock Vested Table Name Mark Mallon Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. Severance Benefits not in Connection with a Change of Control ” ” the earlier of (A) the end of the performance period or (B) the twelve (12)-month period following the date of the qualifying 2023 aTSR PSUs and Agreement Mark Mallon Gina Consylman Thomas McCourt Jason Rickard Michael Shetzline, M.D., Ph.D. $7,583,270. ” Name of Beneficial Owner Named Executive Officers and Directors Mark Mallon(1) Gina Consylman(2) Thomas McCourt(3) Jason Rickard(4) Michael Shetzline, M.D., Ph.D.(5) Mark G. Currie, Ph.D.(6) Andrew Dreyfus Jon R. Duane Marla L. Kessler Julie H. McHugh Catherine Moukheibir Lawrence S. Olanoff, M.D., Ph.D. Edward P. Owens Alexander J. Denner, Ph.D.(7) Jay P. Shepard All current executive officers and directors as a group (14 persons)(8) 5% Security Holders Wellington Management Group LLP(9) Brown Capital Management, LLC(10) Sarissa Capital Management LP(11) The Vanguard Group(12) BlackRock, Inc.(13) Westfield Capital Management Company, LP(14) We have entered into indemnification agreements with each of our current directors and Under our code of business conduct and ethics, our 2024. Audit Audit-related Tax All other Audit fees Other than the foregoing, Ernst & Young 2022. 16-digit control number that is on either the notice of internet availability of proxy materials or the proxy card when voting. household and helps to reduce our expenses. The rule applies to our notices, annual reports, proxy statements and information statements. Proposal No. Stockholders who wish to present a proposal for inclusion in our proxy materials for our 202129

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

SHETZLINE,

M.D., Ph.D.

Officer Senior VicePresident and Head of Research and

Drug

Development of Ironwood

Pharmaceuticals, Inc.62 senior vice presidentand head of research and drug development since October 2021 and had served as chief medical officer, and head of drug development sincefrom January 2019.2019 to October 2021. Dr. Shetzline is a gastroenterologist and internist, with more than 2530 years of experience in the biopharmaceutical industry and academia.Shetzline'sShetzline’s role at Takeda, Dr. Shetzline served as vice president and global head of gastroenterology at Ferring International Pharmascience Center U.S., Inc., or Ferring, from 2012 to January 2015, during which he led Ferring'sFerring’s clinical development programs in gastroenterology. Before that, Dr. Shetzline was vice president and global program head crossing multiple therapeutic areas and head of translational medicine GI discovery at Novartis Pharmaceuticals AG from 2002 to 2012. 30 Ironwood

Compensation Highlight: Performance-based Restricted Stock Units equity compensation program continuedfor 2023 remained aligned with market practice and our corporate performance, which created a strong link between the value of our executives’ compensation and our stockholders’ returns. Together with the objective of linking executive and stockholder interests, our compensation program is also designed to evolveattract, retain, motivate and reward outstanding talent across Ironwood through well-communicated programs that are aligned with our vision and mission, and support a positive company culture and our values. The three primary elements of our executive officer compensation program are base salary, cash bonus and long-term equity incentive compensation. Long-term equity incentive compensation, which includes a balanced mix of time-based and performance-based equity awards, represents a significant percentage of each named executive officer’s target total direct compensation (as defined below). We believe this emphasis on equity strongly reinforces the concept of pay-for-performance, as the single largest component of pay is tied to execution of key performance milestones and future increases in 2020the value of our stock.2021. One key highlight is the addition of performance-based restricted stock units, or PSUs, granted totarget long-term equity incentive compensation, for our named executive officers.In 2020, PSUs replaced stock optionsofficers during 2023 consisted of variable pay elements, as reported in the 2020 executivepay-for-performance compensation program to further tie executive compensation to corporate performance and stockholder value. The PSUs awarded in March 2020 may be earned over a two to three-year performance period based on corporate achievement in three categories: (1) gaining the U.S. FDA acceptancephilosophy of one or more additional NDAs through internal development or acquisition of development-stage or commercial-stage programs, (2) achieving cumulative adjusted organic EBITDA goals, and (3) realizing specified levels of relative stockholder return, or rTSR.In 2021, to further tie the compensation ofmotivating our named executive officers to stockholderachieve our performance objectives in the short term and to grow the business to create sustainable value for our compensation and HR committee determined to have an rTSR performance goal asshareholders in the sole PSU performance metric in our 2021 executive equity compensation program, as measured over a three-year performance period against an expanded peer group.Additional information onlong term. 2023 CEO Compensation 2023 Other NEOs Compensation ![[MISSING IMAGE: pc_ceocompensation-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/pc_ceocompensation-4c.jpg)

![[MISSING IMAGE: pc_neoscompensation-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/pc_neoscompensation-4c.jpg)

awarded to our named executive officers in 2020 and 2021 is provided under the respective captions 2020 Annual Equity Awards and 2021 Annual Equity Awards(as defined below), below.which are valued at target.Stockholder Engagement and Say-On-Pay Vote Consideration ![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)

an annual basis.a frequent basis year-round. This includes investor conferences, investor events, and one-on-one discussions. We invite feedback on a wide variety of topics, including corporate strategy, capital allocation, governance, human capital management and executive compensation. In 2020, senior management met with the majority of Ironwood's largest 20 stockholders, which represented over 85% of our outstanding shares as of December 31, 2020. In addition, Alexander J. Denner, Ph.D., who is the chief investment officer of Sarissa Capital Management LP, one of our largest stockholders, joined our board in November 2020."say-on-pay"“say-on-pay” vote, every year. This allows our stockholders to provide us with regular, timely and direct input on our executive compensation philosophy, policies and practices. We believe this enables us to further align our compensation programs with our stockholders'stockholders’ interests and to enhance our ability to consider stockholder feedback as part of our annual compensation review process. We sought stockholder input on our executive compensation program through the say-on-pay vote at our 20202023 annual meeting of stockholders and approximately 84%98% of votes cast by our stockholders voted in support of our named executive officer compensation.2021 Proxy Statement 31

Named Executive Officers: Goals and Accomplishments 202020202023 were:Mark Mallon, formerGina Consylman,senior vice president; Thomas McCourt, president and interim chief executive officer; •Jason Rickard, chief operating officer and senior vice president; and •senior vice president and head of research and drug development.Mr. Rickard and Dr. Shetzline became executive officers of Ironwood effective April 17, 2020. Effective March 12, 2021, Mr. Mallon resigned from his position as Ironwood's chief executive officer and Mr. McCourt became our interim chief executive officer in addition to his continued service as our president. For more information on our chief executive officer transition, please see Chief Executive Officer Transition elsewhere in this proxy statement.late 2019,early 2023, our board, with input from senior management, established what it believed were challengingour 2023 corporate performance goals for 2020,and the relative weighting of such goals, the achievement of which we believed would further the accomplishment of our short- and long-term business plan. These goals included maximizing LINZESS net sales growth as well as the attainment of certain financial and pipeline targets, in each case, based on the Company'scompany’s board-approved operating plan for 2020. In early 2020,2023, as well as goals related to our compensationworkforce, strategy and HR committee approved the relative weighting of our corporate performance goals for 2020. (except Mr. Mallon) were evaluated based on the level of achievement of the 20202023 corporate goals and their achievements in 2020, including additionalagainst their 2023 individual goals that contributed toward, and related directly to, the accomplishment of the 2020 corporate goals. The compensation and HR committee and board determined to equate Mr. Mallon's individual performance with the company's overall corporate performance, and, as a result, assessed Mr. Mallon's performance based on the achievement of the 2020 corporate performance goals and accomplishments. Performance measured against the 20202023 corporate and individual goals (as applicable) was used, in part, in determining salary adjustments and cash bonus awards for our named executive officers in early 2021. beginning in 2021, our board becameis responsible for assessing the Company'scompany’s performance against its pre-determined corporate goals. Thus, inIn January 2021, 2024, our board determined that the 20202023 company performance achievement multiplier, which was used as a key consideration in determining executive compensation awarded for 20202023 performance, was 101%120%. When assessing corporate performance for 2020, our board noted that certain of our corporate goals for 2020 were met or exceeded despite the challenges posed by the COVID-19 pandemic. No COVID-19-related adjustments were made to goals, expectations or compensation targets for our named executive officers in 2020.32 Ironwood

![[MISSING IMAGE: htr_greenorangebanner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/htr_greenorangebanner-4c.jpg)

20202023 corporate performance goals, as determined by our board in early 2021,2024, was as follows:![[MISSING IMAGE: bc_line-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/bc_line-4c.jpg)

Notes to 2023 Company Performance Targets and Results Table Company Goal Partially

Achieved Target Over

Achieved Results MAXIMIZE LINZESS (30%) LINZESS U.S. Net Sales $1,022M $1,051M $>1,070M $1,073M(1) Achieve U.S. FDA approval of sNDA for pediatric patients ages 6-17 years old with FC Specific goals are not disclosed for

competitive reasons Above Target(2) Commercial launch target date of LINZESS for pediatric patients ages 6-17 years old with FC as measured by a launch scorecard Specific goals are not disclosed for

competitive reasons Above Target(3) (20%) (30%) (40%) (40%) BUILD INNOVATIVE PIPELINE (30%) Secure 1 asset aligned with prioritized criteria Specific goals are not disclosed for

competitive reasons Above Target(4) Achieve CNP-104 enrollment target Specific goals are not disclosed for

competitive reasons Target(5) Achieve IW-3300 enrollment target Specific goals are not disclosed for

competitive reasons Below Target(6) (20%) (30%) (50%) (35%) STRENGTHEN FINANCIAL PROFILE (35%) Adjusted EBITDA from organic business (excluding the impact of any corporate development transactions and costs associated with a potential CNP-104 option exercise) $235M $250M $>260M $268M(7) (30%) (35%) (40%) (40%) CREATE GREAT PLACE TO WORK (5%) Achieve a certain number of objectives on the corporate DEI scorecard Committee judgment

on actual

performance Specified Number N/A Target(8) Maintain confidence in Ironwood’s strategy and culture, measured by positive response rate range on annual employee engagement survey Committee judgment

on actual

performance >50% N/A Target(9) (5%) (5%) TOTAL 120% Corporate

Goal Stockholder

Impact Achievements Target

Percentage

(%) Actual Level of

Achievement

(%) Drive LINZESS Growth Grows the revenue base 30 % 40 % Advance our Pipeline Advances future business growth and profitability 30 % 30 % Expand our impact in GI Supports potential for long-term growth and profitability 20 % 6 % Invigorate Ironwood Helps to attract, motivate and retain top talent 5 % 5 % Strengthen our financial profile Enables Ironwood to invest thoughtfully without reliance on capital markets 15 % 20 % Totals 100 % 101 % Stretch Goals for Additional Potential Achievement 50 % 0 % TOTALS 150 % 101 % * AdjustedGoal exceeded. LINZESS U.S. net sales were $1,073 million for the year ended December 31, 2023. LINZESS U.S. net sales are reported by our U.S. partner, AbbVie.from continuing operationswhich was calculated by subtracting mark-to-market adjustments on derivatives related to Ironwood’s 2022 Convertible Notes, restructuring expenses, net interest expense, income taxes, depreciation and amortization, mark-to-market adjustments on derivatives related to Ironwood's 2.25% convertible notes due 2022, restructuring expenses,and acquisition-related costs, from GAAP net income, (loss)was ($884.8) million for the year ended December 31, 2023. When excluding from continuing operations.adjusted EBITDA the impact of corporate development activities in 2023, which include all profit and loss incurred by VectivBio subsequent to the VectivBio acquisition, and the payment recognized in the second quarter of 2023 in connection with the amendment of the COUR Collaboration Agreement, our adjusted EBITDA from our organic business was $267.6 million for the year ended December 31, 2023.202133

![[MISSING IMAGE: hr_greenltsm-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-051992/hr_greenltsm-4c.jpg)